Michael Porter developed Porter’s Five Forces to help companies analyze their competitiveness in the marketplace. It looks at five different factors that affect the flow of pricing and power within an industry.:

- Buyer power

- Supplier power

- Competitive rivalry

- The threat of substitution.

- The threat of new entry

Why Use Porter’s Five Forces Analysis?

As different factors change, so does the market that you’re working in. Buyer power waxes and wanes with shifts in the economy. Supplier power changes depending on the availability of their product and the presence of alternative products and suppliers. New competitors appear. Different products appear that might be a substitute for yours. Your existing competitors gain or lose ground against each other and you.

Market changes can easily take a company by surprise. Also, If you look back over history, you’ll see numerous examples. It abounds with once-leading global corporations that failed to move with the times and ended up in receivership or severely weakened. That’s why you run analyses using this framework: to keep track of the market, how it’s changing, and your position within it.

History of Porter’s Five Forces

Michael E. Porter introduced the business analysis framework known as Porter’s Five Forces in his 1979 book, “Competitive Strategy: Techniques for Analyzing Industries and Competitors.” As a Harvard Business School professor, Porter devised this model to assist businesses in evaluating the competitive forces within their industry and formulating effective strategies to achieve a competitive advantage

Porter’s Five Forces Explained

Buyer Power

Customers have power in the marketplace. If no one buys a product, it will fail; In other words, When the number of buyers is relatively low compared to the number of suppliers in an industry, it results in what is referred to as “buyer power,” which is a key aspect of the Five Forces framework.

Buyer power, reflecting customers’ ability to influence prices, is influenced by factors such as the quantity and significance of buyers, as well as the costs associated with acquiring new customers or entering new markets for a company’s output. So you need to meet customer requirements before you can successfully sell it.

Consumers express this power by:

- Refusing to buy a product.

- Choosing a different supplier or brand of product.

- Returning a product that doesn’t meet their expectations.

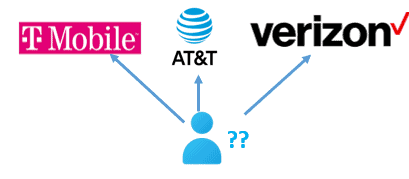

Example

In the mobile network industry, buyer power emerges when a few major providers serve a large consumer base. This gives consumers influence to demand competitive prices and superior services. The ease of switching providers (number porting) amplifies this power, compelling mobile network companies to prioritize consumer preferences for sustained competitiveness.

What can a customer actually achieve with this power, though? Well, they can typically push for:

- Better quality of the product.

- Lower prices.

- Improved customer service or support.

However, there are other forces at play. These affect how much pressure buyers can exert. For example:

- How many similar products are available? If buyers have a lot of choices, you need to offer more.

- The ratio of sellers to buyers. If many suppliers are competing for a few buyers, the buyers can essentially set their own terms.

- How much it cost to switch sellers? The more difficult and expensive it is to switch, the fewer sellers need to worry about losing customers.

- The amount and frequency of purchases. Also, If a buyer spends a lot, often, they’re a more valuable customer.

Supplier Power

Suppliers might be on the opposite side of the supply chain from buyers, but they also have the power to affect the marketplace. If suppliers are the sole source for a specific service, they will have significant supplier power. Assessing the cost implications of switching providers is crucial, even if alternatives exist. A company’s dependence on a supplier intensifies when there are fewer options available in the industry.

Suppliers can express power by:

- Changing the prices at which they sell products.

- Modifying the level of quality in their products.

- Increasing or decreasing product availability.

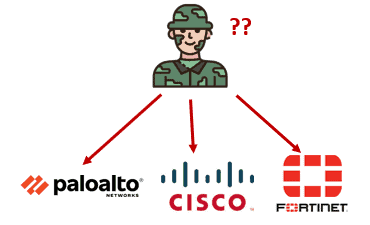

Example

In the realm of military IT, supplier power is exemplified when a few specialized companies provide crucial technologies for national defense. If a particular supplier is the sole source of vital cybersecurity systems, they hold significant influence. Despite the potential to explore alternatives, the military must carefully weigh the complexities and costs of transitioning such sensitive technologies, highlighting the substantial supplier power in the defense sector.

The forces that affect a supplier’s power are similar to those for buyers, only in reverse. This is because the company-supplier relationship is in many ways the reverse of the company-buyer relationship. So the factors affecting supplier power include:

- How many similar products are available? Does the supplier offer a unique or rare raw material? If they do, and you need that material, supplier power is high. On the other hand, if you have a lot of choices, then supplier power is lower.

- The ratio of suppliers to companies like yours. Are there numerous suppliers servicing your industry? If many suppliers are competing for sales from a few companies, then supplier power is decreased.

- How much it costs to switch suppliers? If it will be difficult and expensive for you to change, then supplier power is increased. If it will be simple and cheap, then supplier power is lowered.

- The amount and frequency of your purchases. If you buy a lot and often, supplier power is lower because you’re a more valuable customer.

Competitive Rivalry

Competitive rivalry is one of the important Porter’s Five Forces. Examining the level of competition among existing firms in the industry. It reveals that the larger the number of competitors, along with the quantity of equivalent products and services they offer, the lower the power of a company.

In industries characterized by intense rivalry, companies attract customers through aggressive price-cutting and high-impact marketing campaigns. High competition frequently results in price wars and diminished profitability.

Competitors can express power by:

- Introducing innovative products or services

- Implementing effective marketing campaigns

- Optimizing operational efficiency

- Enhancing customer experiences

- Strategically adjusting pricing structures

Example

In the smartphone industry, competitive rivalry is evident among major players like Apple, Samsung, Motorola, and Huawei. Intense competition drives constant innovation, aggressive marketing, and price wars to capture market share. Companies strive to differentiate through cutting-edge features, compelling designs, and staying responsive to evolving consumer preferences, highlighting the dynamic nature of competitive rivalry in this sector.

The threat of substitution

This concept pertains to the ease with which customers can switch to alternatives instead of your product. It becomes relevant when customers can either function adequately without your product or perform the service you offer independently. The buyer is at the tail end – essentially this is the power to drive down prices.

The existence of substitute goods or services poses a threat. You’ll eventually find yourself with a cap on potential profits. The companies producing items without close alternatives wield more power to raise prices and secure favorable terms.

The threat of substitution can express power by

- Availability of substitutes

- Consumer preferences

- Uniqueness of offerings

- Price sensitivity

Example

The threat of substitution is exemplified in the beverage industry, where health-conscious consumers can easily opt for alternatives like flavored water, teas, or fruit juices over traditional carbonated drinks. This poses a challenge for soda manufacturers as changing consumer preferences impact their market share. To navigate this threat, companies must innovate and provide distinct value propositions to retain their customer base.

The threat of new entry

The company’s power is also influenced by the impact of new entrants in its market. In other words, your standing can be influenced by the capability of potential rivals to enter your market.

The threat of new entry assesses how easily individuals can establish a business in your industry and offer comparable products to your target market. If building a successful business in your industry demands a significant investment of time and money, you will probably face fewer competitors

The threat of new entry can express power by

- Time & cost of entry

- franchise fees, licenses

- Capital requirements

- Expensive new equipment.

- Barriers to entry

- Legal (Ex. No more net neutrality)

Example

The threat of new entry in the Over-the-Top (OTT) streaming industry is exemplified by newcomers like Netflix, Prime Video, YouTube, and Disney+. These platforms, with low entry barriers facilitated by digital distribution, have reshaped the entertainment landscape. Furthermore, traditional TV providers face the challenge of adapting to the changing consumer preferences and technological advancements introduced by these innovative OTT services.

Difference between Porter’s Five Forces and SWOT Analysis

Porter’s Five Forces and SWOT Analysis are distinct strategic management tools. Porter’s Five Forces focuses on analyzing the competitive forces within an industry, examining factors like the power of buyers and suppliers, the threat of new entrants, substitutes, and the intensity of rivalry. In contrast, SWOT Analysis takes a broader perspective, considering both internal factors (Strengths and Weaknesses) and external factors (Opportunities and Threats).

While Porter’s Five Forces is more focused on the current competitive landscape and industry attractiveness, SWOT Analysis encompasses a comprehensive evaluation of an organization’s internal capabilities and its external environment, providing insights for holistic strategic planning.

Advantages of Porter’s Five Forces

Porter’s Five Forces is to analyze the competitive forces that shape an industry and determine its attractiveness. Furthermore, the advantages of using Porter’s Five Forces analysis include:

- Offers insight into industry structure and key forces influencing competition.

- Identifies current and potential competitors, aiding comprehensive assessment.

- Assists in formulating effective strategies by analyzing the impact on profitability.

- Evaluates industry-related risks, enabling the development of mitigation strategies.

- Guides decisions on entering new markets by assessing competition and barriers.

- Analyzes supplier and buyer power dynamics for effective negotiations.

- Helps organizations adapt to industry changes by understanding external forces.

- Allows businesses to benchmark their industry, providing insights into relative strengths.

Example of Porter’s Five Forces

Create Porter’s Five Forces analysis for a news channel.

Threat of New Entrants:

The news industry demands significant upfront investments in infrastructure, technology, and a network of reporters. Compliance with media regulations and licensing requirements adds complexity for new players.

Buyer Power:

Viewers can easily switch between news channels or opt for online sources, reducing the channel’s power. With various news channels and online platforms available, viewers have multiple choices, impacting the channel’s influence.

Supplier Power:

News channels rely on skilled journalists and content providers, giving them significant bargaining power. Also, the scarcity of experienced journalists may empower them to negotiate favorable terms.

The threat of substitution:

The rise of digital news platforms poses a threat, offering convenient alternatives to traditional TV channels. Furthermore, platforms like Twitter and Facebook serve as alternative sources for real-time news, impacting traditional viewership.

Competitive Rivalry:

News channels fiercely compete for audience attention, leading to constant innovation in content delivery and presentation. The 24/7 news cycle intensifies rivalry as channels strive to be the first with breaking news, impacting advertising revenue.

Important Videos

When you’re ready, there are a few ways I can help:

First, join 30,000+ other Six Sigma professionals by subscribing to my email newsletter. A short read every Monday to start your work week off correctly. Always free.

—

If you’re looking to pass your Six Sigma Green Belt or Black Belt exams, I’d recommend starting with my affordable study guide:

1)→ 🟢Pass Your Six Sigma Green Belt

2)→ ⚫Pass Your Six Sigma Black Belt

You’ve spent so much effort learning Lean Six Sigma. Why leave passing your certification exam up to chance? This comprehensive study guide offers 1,000+ exam-like questions for Green Belts (2,000+ for Black Belts) with full answer walkthroughs, access to instructors, detailed study material, and more.